operating cash flow ratio good

An operating cash flow margin is a measure of the money a company generates from its core operations per dollar of sales. For instance if 90 days receivables are outstanding it means on an average the company extends credit for 90360 25 of its sales at any given point of time.

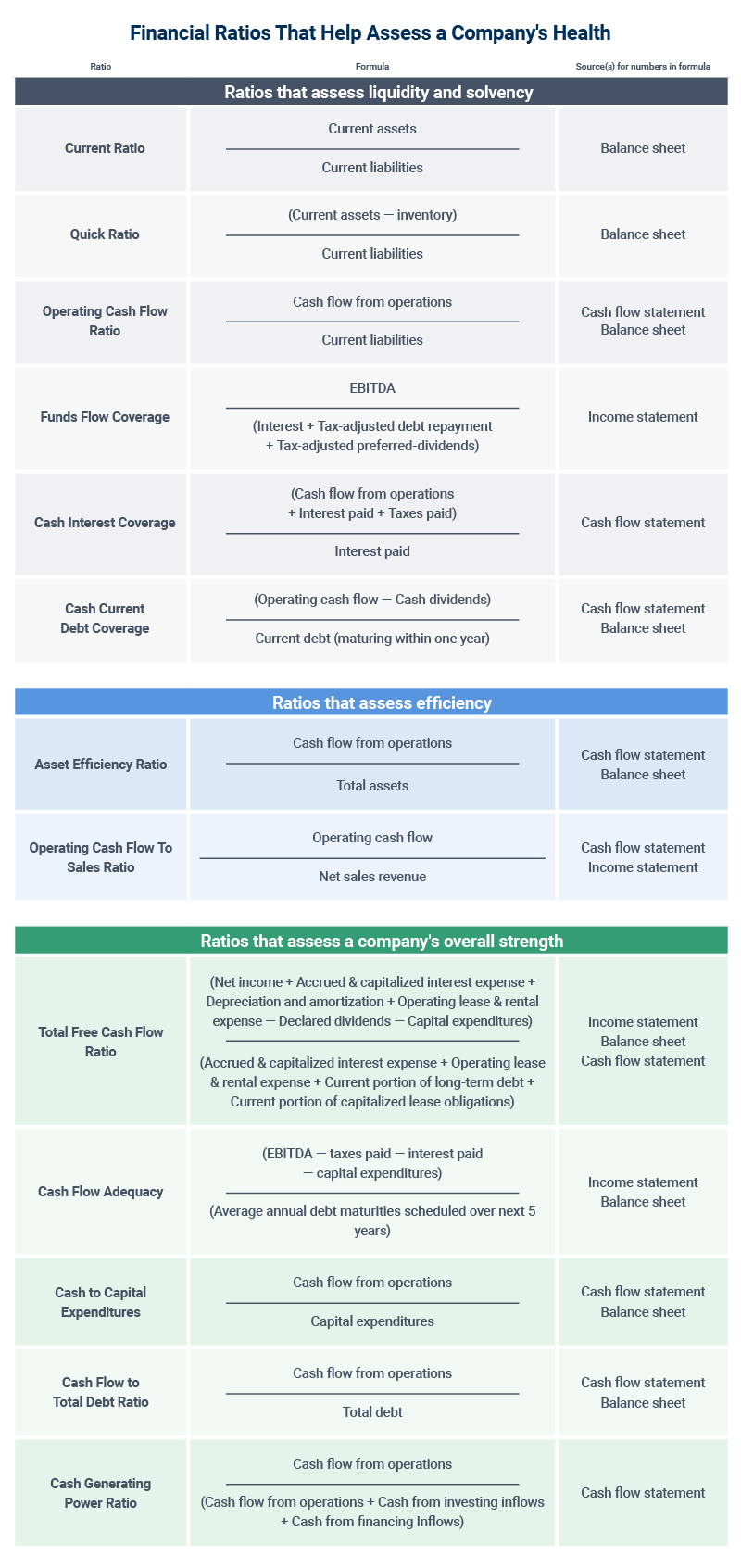

The 10 Cash Flow Ratios Every Investor Should Know

There is no standard guideline for operating cash.

. For example we already know that AAA Manufacturing. The operating cash flow ratio also known as a liquidity ratio is an indicator which helps to determine whether a company is able to repay its current liabilities with cash flow coming. Cash returns on assets cash flow from operations Total assets.

Operating Cash Flow - OCF. This ratio is a type of coverage ratio and can be. High cash flow from operations ratio indicates better liquidity position of the firm.

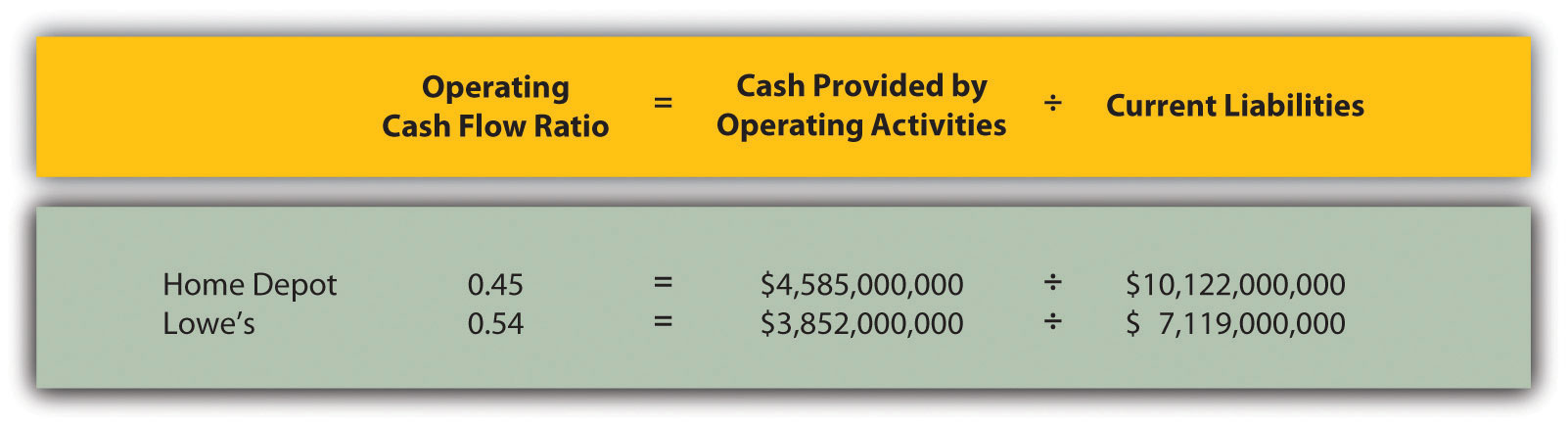

It measures the amount of operating cash flow generated. Lets consider the example of an automaker with the following financials. The operating cash flow ratio is a measure of how well current liabilities are covered by the cash flow generated from a companys operations.

Operating cash flow is a measure of the amount of cash generated by a companys normal business operations. 250000 120000 208. However they have current liabilities of 120000.

Operating Cash Flow Margin. The Operating Cash to Debt ratio is calculated by dividing a companys cash flow from operations by its total debt. You can work out the operating cash flow ratio like so.

Ideally your operating cash flow ratio should be fairly close to 11 meaning you make 10p per 1 you. Cash Flow-to-Debt Ratio. Calculation formula The formula for this ratio is simple.

High Low Operating Cash Flow Ratio. This means that Company A earns 208 from operating. This ratio can be calculated from the following formula.

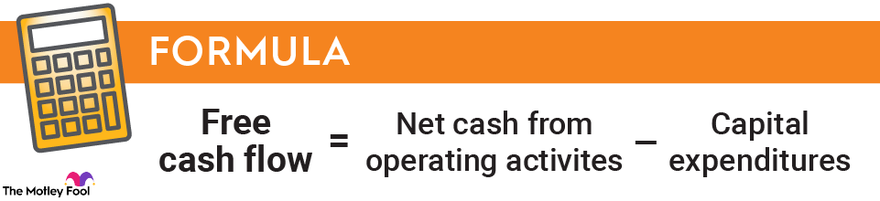

Ad Integrate book keeping with all your operations to avoid double entry. Hence with the operating cash flow ratio formula. Calculating the free cash flow to sales ratio requires an additional step subtracting capital expenditures from operating cash flow.

Try for Free Today. Operating cash flow Net cash from operations Current liabilities. The Operating Cash Flow Ratio is a liquidity ratio its a measure of how well a company can pay off its current liabilities with the cash flow generated from its core business operations.

Operating cash flow Sales Ratio Operating Cash Flows Sales Revenue x. The price-to-cash flow ratio is a valuation ratio useful when a business is publicly traded. The cash flow-to-debt ratio is the ratio of a companys cash flow from operations to its total debt.

The operating cash flow ratio is a measurement that indicates whether the cash created from continuing operations is sufficient. Since the ratio is lower than 1 it indicates that. OCR Ratio Cash flow from operating activities Current liabilities 872 975 089.

Example of Cash Returns on Asset Ratio. Operating Cash Flow Ratio Definition. The formula to calculate the ratio is as.

Operating cash flow indicates. The formula to calculate the ratio is as follows. Thus in this case the operating.

Automate your vendor bills with AI and sync your banks. The CAPEX to Operating Cash Ratio is calculated by dividing a companys cash flow from operations by its capital expenditures. Operating Cash Flow Ratio.

Cash Flow Coverage Ratios Aimcfo

Debt To Operating Cash Flow Ratio Appforfinance

Operating Cash Flow Margin Formula And Calculation

Operating Cash Flow Basics Smartsheet

Cash Flow Per Share Formula Example How To Calculate

Cash Flow From Operations Ratio Top 3 Examples Of Cfo Ratio

Operating Cash Flow Ratio Calculator

Free Cash Flow Defined And Calculated The Motley Fool

/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-01-5374391bf75040dfa769ad9661c90b89.jpg)

Cash Flow Statements Reviewing Cash Flow From Operations

How To Prepare A Cash Flow Statement Hbs Online

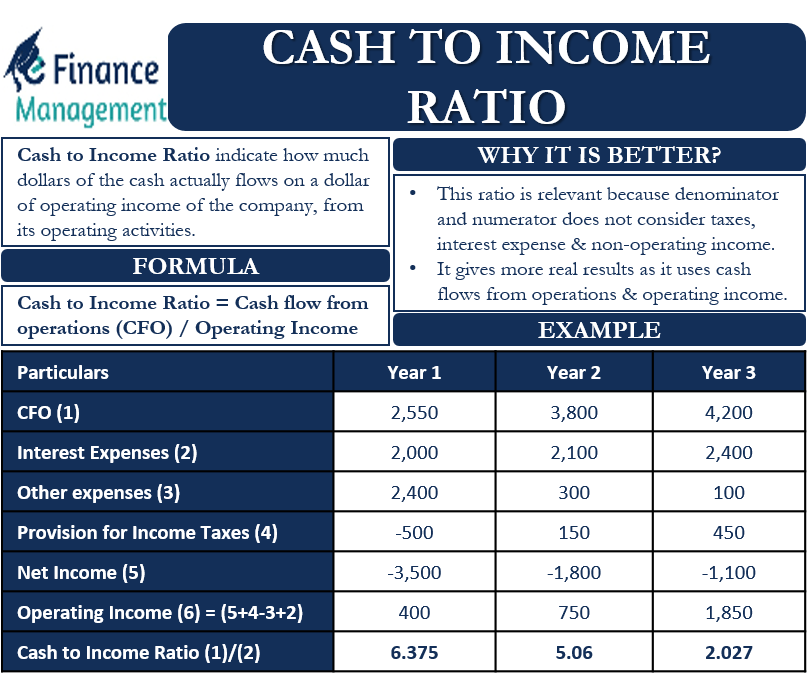

Cash To Income Ratio Meaning Formula Example And More

How To Calculate Cash Flow 3 Cash Flow Formulas Calculations And Examples

Financial Ratios Calculations Accountingcoach

Operating Cash Flow Ratio Know Your Numbers

Operating Cash Flow Formula Calculation With Examples

Answered Cash Flow On Total Assets Ratio Is Bartleby