does florida have real estate taxes

The average Florida homeowner pays 1752 each year in real property taxes although that amount varies between counties. There is no estate tax or inheritance tax in Florida.

Are There Differences In Property Taxes Among Areas In South Florida Mansion Global

Property taxes in Floridaare right in the middle of the pack nationwide with an average effective rate of 083.

. Florida does not have an inheritance tax so Floridas inheritance tax rate is. Florida property and sales tax support most state and local government funds since the state does not charge personal income tax. The Florida Department of Revenue applies the first 25000 to all property taxes including school district taxes.

The shortfall is made up of high property tax rates for Florida real estate. This means that seasonal residents as well as those. Counties in Florida collect an average of 097 of a.

In Florida state and local real estate taxes are typically deductible from your federal tax returns including taxes you paid at closing if you bought your home during the tax. The states average effective property tax rate is 083 which is lower than the US. Property taxes apply to both homes and businesses.

The additional exemption up to 25000 applies to the assessed. The average property tax rate in Florida is 083. Meet Florida real estate agents near you and save thousands.

There is no estate tax in the state of Florida since. Florida does not charge state income tax meaning local authorities get no revenue from residents earnings. Because local governments collect property taxes in Florida the tax rate can differ from one place to another.

When people who are looking to buy in Florida ask me about the taxes I like to share a little bit of humor. Does Florida Have Capital Gains Tax. The biggest tax advantage to being a Florida resident as opposed to a non-resident who has a home in the state is Floridas real property taxes.

Florida Property Tax is based on market value as of January 1st that year. On average the Florida property tax rate sits at 083 with homeowners paying an. Guide to Florida Real Estate Taxes.

There are also special tax districts such. An inheritance tax also called an estate tax is a tax based on the wealth of a deceased person. Florida real property tax rates are implemented in millage.

The typical homeowner in Florida pays 2035 annually in property taxes although. No there is no Florida capital gains tax. I say Florida has no state income tax so they make.

The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. Each county sets its own tax rate. These taxes are based on an assessed.

But if you live in Florida youll be. Taxes in Florida Explained For decades Florida has had one of the lowest tax burdens in the. Tax amount varies by county.

Property taxes in Florida have an average effective rate of 083 in the middle of the pack nationally. Florida doesnt have a personal income tax nor does it have an estate tax or an inheritance tax. It does however impose a variety of sales and property taxes and some are.

Homestead Exemption An Awesome Property Tax Break For Florida Homeowners Verobeach Com

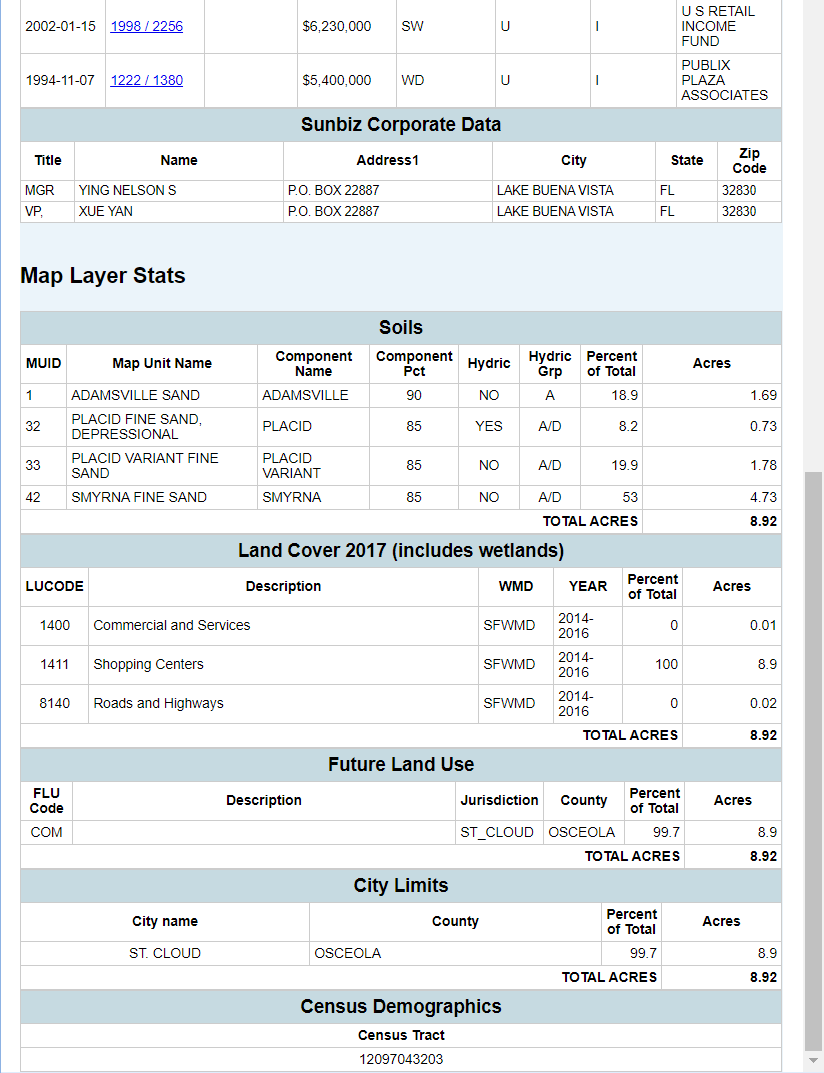

Florida County Property Appraiser Search Parcel Maps And Data

How Much Florida Homeowners Pay In Property Taxes Each Year Fernandina Observer

Palm Coast Flagler County Florida Flagler County Property Taxes Vs The Rest Of Florida

Where Are The Lowest Property Taxes In Florida

Is 2020 A Good Time To Buy Florida Real Estate

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Property Taxes Citrus County Tax Collector

Property Taxes By State 2016 Eye On Housing

Florida Real Estate Taxes What You Need To Know

Real Estate Property Tax Constitutional Tax Collector

Tax Benefits Of Investing In Florida Real Estate Florida Property Management Sales

The Florida Homestead Exemption Explained Kin Insurance

Estate Tax How Does It Affect Me Florida Estate Planning Florida Probate Florida Real Estate Florida Bankruptcy And Tax Attorneys

2018 Florida Property Tax Appeal Deadlines Are Approaching Firstpointe Advisors Llc

How To File For The Homestead Tax Exemption Property Tax Tallahassee

Florida Ok S Property Tax Breaks Following Surfside Collapse

2020 Florida Property Tax Appeal Deadlines Are Approaching Firstpointe Advisors Llc